Keep your money secure by learning how you can act to avoid common types of fraud and scams.

Overlay

Impersonation scams

Scams where someone pretends to be from your bank or police, or someone else who you trust.

Information Message

Purchase scams

Scams when buying products or services.

Information Message

Investment scams

Scams targeting your investments.

Information Message

Romance scams

Scams that exploit love and friendships.

Information Message

Telephone fraud

Fraudulent calls you get on the phone.

Information Message

Email fraud

Fraud that comes to your inbox.

Information Message

Text fraud

Fraud sent through text messages and other messaging channels.

Information Message

Money mule scams

Scams that use you to move money illegally.

Information Message

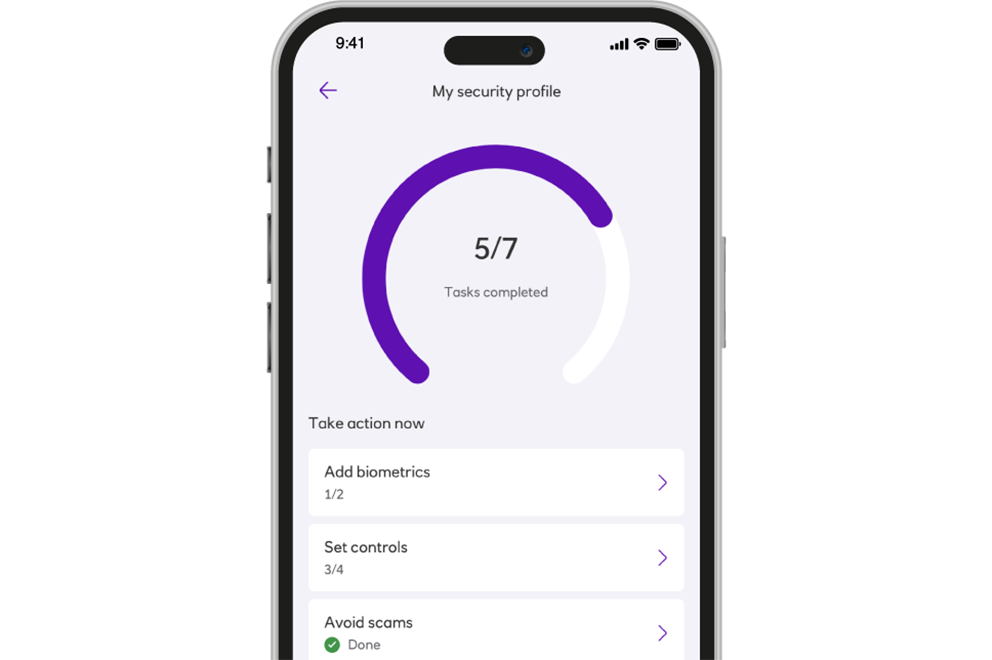

See why My Security Profile has over 10 million visits

With so many visits to My Security Profile, it's clear that people like you are putting their security first.

Personalised steps to protect yourself are just a few taps away.

Ready to experience it for yourself?