On this page

Know:

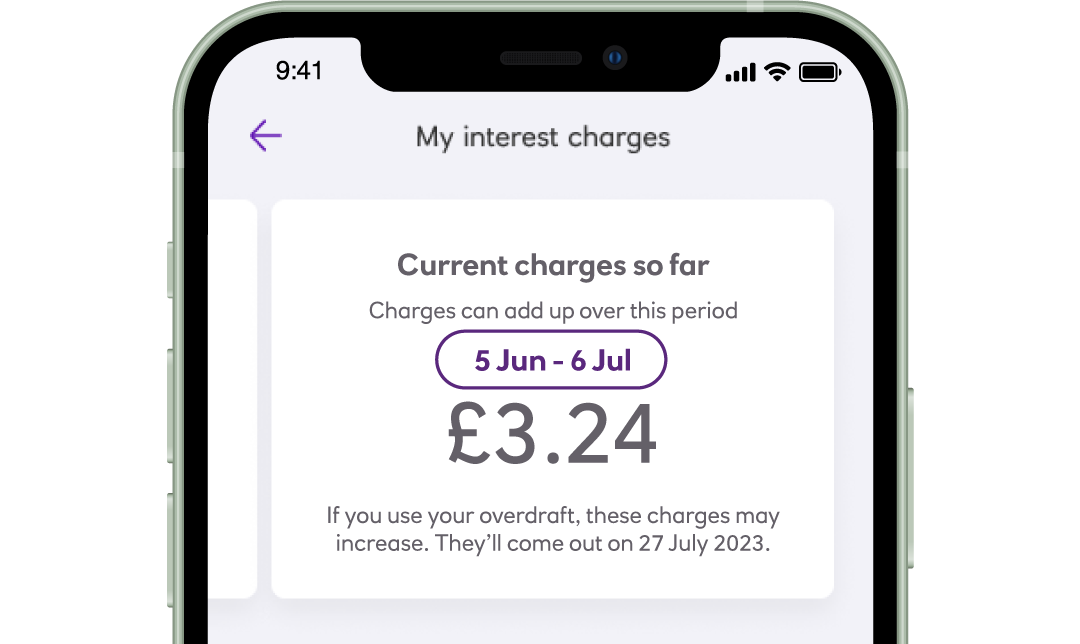

How much your interest is adding up to, as you spend on your overdraft

How does knowing this help me?

- You’re charged interest on the days you use your overdraft.

- Your charges will update overnight.

- You can track how much your overdraft costs to help with decisions.

Check:

Your charging period dates, of when interest can add up

How does knowing this help me?

- Your charging period may not run in a calendar month because it’s based on when you get your current account statement.

- You can see when any charges are due to come out of your account.

Prepare:

Check the date the final interest charge will be taken out your account

How does knowing this help me?

- You may have charges taken out during a month when you’re not using your overdraft, because they’re for the previous period.

- You can see when charges due to come out in the app.

- You’ll also get a pre-notification statement of interest and charges sent to your app mailbox under your Profile.

Anytime Banking

To find the ‘My Overdraft’ feature you need to:

- Log into Anytime Banking

- Select the ‘More’ option next to ‘View transactions’. Then select ‘View overdraft’

- You will then be able to view your monthly interest charges so far.

Anytime Banking available to customers aged 11+ with an eligible Ulster Bank Northern Ireland account.

Mobile app

To find the ‘My Overdraft’ feature you need to:

- Open the Ulster Bank app and click on your chosen current account.

- Select 'My Overdraft' and 'View current interest charges'

- You will then be able to view your monthly interest charges so far.

App available to personal and business customers aged 11+ using compatible iOS and Android devices and a UK or international mobile number in specific countries.

Want to work out how much using your overdraft costs?

Use our overdraft cost calculator to estimate how much interest you’d pay, based on your own circumstances and borrowing amount. The overdraft cost calculator can also be accessed via the 'My overdraft' section in the mobile app.