Enjoy 0% interest for up to 12 months on balance transfers and no balance transfer fee

Your card at a glance

- 0% interest on balance transfers for up to 12 months –you must transfer your balance in the first 3 months of account opening. 0% offer starts from account opening.

- 0% interest on purchases for the first 3 months – 0% offer starts from account opening.

- Zero balance transfer fee – enjoy zero interest without paying a fee for the privilege.

- After your 0% offers end – you'll pay our standard rates.

Just so you know... You can transfer a balance (move debt) from most credit cards or store cards. You can’t transfer from NatWest Group credit cards. You can't move debt from or a loan, or overdraft. You must transfer at least £100. The most you can transfer is up to 95% of your credit limit.

You must be a UK resident, aged 18+ and earn 10k+ each year.

Representative example

Representative APR (variable):

24.9%

Assumed credit limit:

£1,200

Purchase rate:

24.9% p.a. (variable)

Annual fee:

£0

Your credit limit, APR and 0% offer may be different from the above. It depends on our credit assessment of you. Your purchase and balance transfer rate could be up to 29.9% p.a. (variable). Your 0% offer on balance transfers could be between 10 and 12 months. For info on how we charge interest on fees and charges, read our terms and conditions, or see our Summary Box.

Your card at a glance

- 0% interest on balance transfers for up to 12 months –you must transfer your balance in the first 3 months of account opening. 0% offer starts from account opening.

- 0% interest on purchases for the first 3 months – 0% offer starts from account opening.

- Zero balance transfer fee – enjoy zero interest without paying a fee for the privilege.

- After your 0% offers end – you'll pay our standard rates.

Just so you know... You can transfer a balance (move debt) from most credit cards or store cards. You can’t transfer from NatWest Group credit cards. You can't move debt from or a loan, or overdraft. You must transfer at least £100. The most you can transfer is up to 95% of your credit limit.

You must be a UK resident, aged 18+ and earn 10k+ each year.

Representative example

Representative APR (variable):

24.9%

Assumed credit limit:

£1,200

Purchase rate:

24.9% p.a. (variable)

Annual fee:

£0

Your credit limit, APR and 0% offer may be different from the above. It depends on our credit assessment of you. Your purchase and balance transfer rate could be up to 29.9% p.a. (variable). Your 0% offer on balance transfers could be between 10 and 12 months. For info on how we charge interest on fees and charges, read our terms and conditions, or see our Summary Box.

Check your eligibility. (Won't harm your credit score.)

Find out if we'll say 'yes' before you apply

It takes less than 10 minutes and won't affect your credit score.

To transfer the balance, you'd pay a fee of...

To transfer the balance, you'd pay a fee of...

To transfer the balance, you'd pay a fee of...

To transfer the balance, you'd pay a fee of...

The fee is this percentage of debt shifted...

The fee is this percentage of debt shifted...

The fee is this percentage of debt shifted...

The fee is this percentage of debt shifted...

Purchase & Balance Transfer card

Representative example:

Purchase rate: 24.9% p.a (variable)

Representative APR: 24.9% (variable)

Assumed credit limit: £1200

Annual fee: £0

Your actual credit limit, 0% interest promotional period and APR may vary depending on your credit check. Please see our terms and conditions for more details about the interest on fees and charges we charge.

Longer Balance Transfer card

Representative example:

Purchase rate: 24.9% p.a (variable)

Representative APR: 24.9% (variable)

Assumed credit limit: £1200

Annual fee: £0

Your actual credit limit, 0% interest promotional period and APR may vary depending on your credit check. Please see our terms and conditions for more details about the interest on fees and charges we charge.

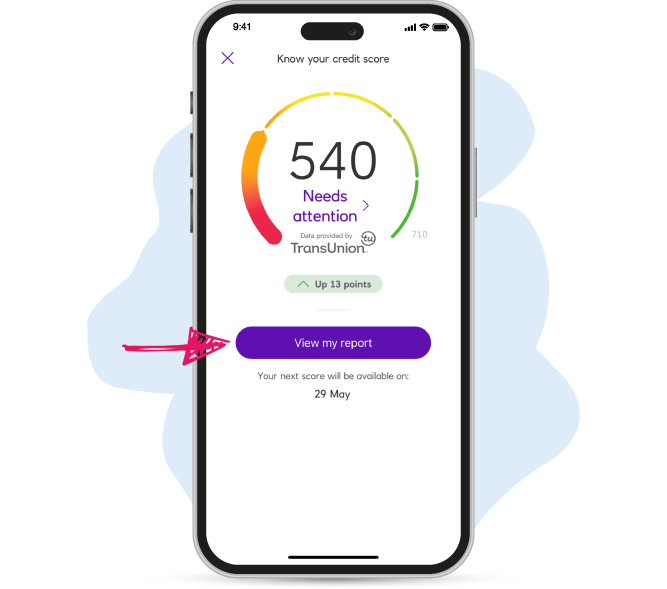

Get a free credit score, and more

Get a free credit score in our app

Plus tips to improve your credit score

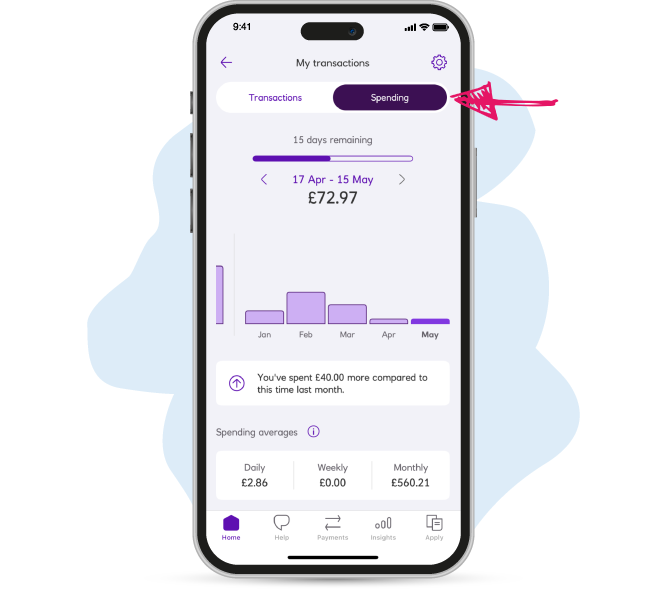

Pay with Apple Pay or Google Pay

It's easy, safe and quick

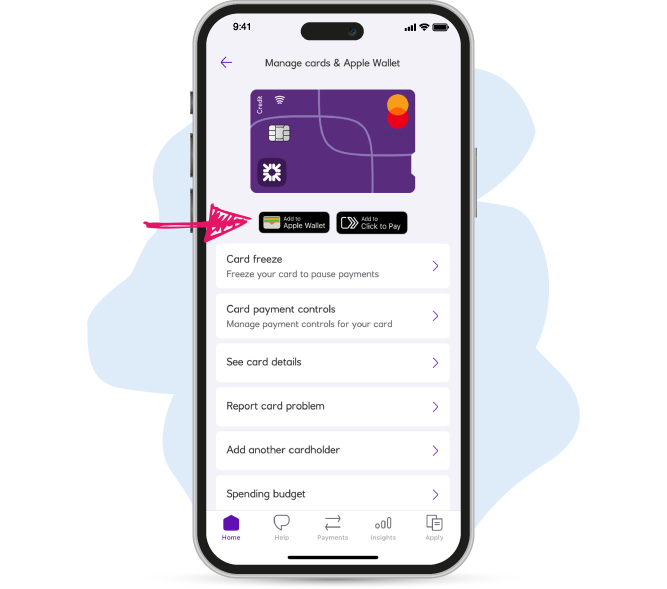

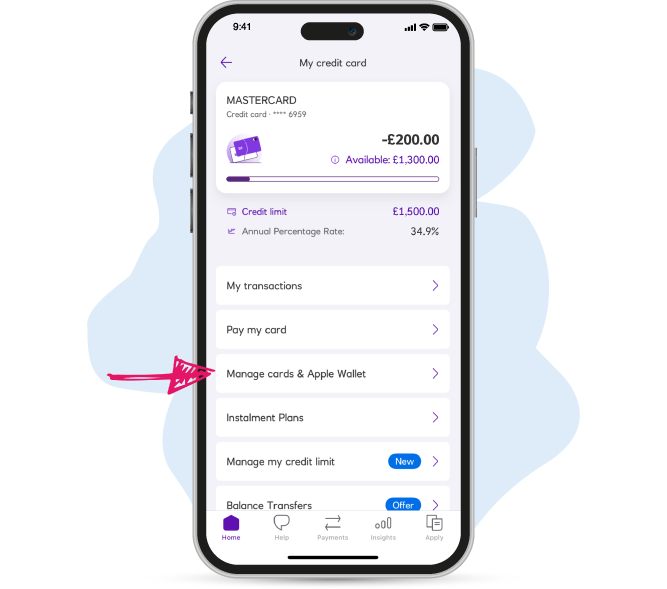

Use our quick and simple app

See your PIN, replace a card, and more

Manage your card in the app

Plus, get spending alerts

Ready to apply? Okay, let's start by checking your eligibility...

Please take your time to read this page and decide if this card is right for you. Unsure? Try our borrowing options tool.

We'll start by checking your eligibility – this won't hurt your credit score

At the start of your application, we'll say if you could get this card and what it could cost you. It’s then up to you if you want to go ahead.

To apply for a credit card, you must:

- Be 18+, live in the UK and earn 10k+ each year.

- Not have been bankrupt in the last 6 years. (Got a joint account? They must not have been bankrupt in the last 6 years either.)

All good? Here's a bit more info: