On this page

Understanding credit decisions

If you’ve been turned down after applying to borrow money, there may be a few reasons why. For example, your credit score may be too low or your income and outgoings may make paying back any lending difficult.

For more information on our credit decisions, how to make an appeal and useful resources that can help you to review your financial circumstances visit our credit decisions page.

Financial things

How much money you owe

Missed or late payments

Defaulting or breaking the terms of credit agreements

Going close to or over your credit limit

Making cash withdrawals using your credit card

Applying for credit too often in a short space of time

Non financial things

Registering on the electoral roll

Moving house

Connections with other people (e.g. your spouse)

Errors on your credit file

Check your score for free in the Ulster Bank app

From full credit report and proactive alerts to score predictor and personalised insights, we have a selection of features to help you stay on top of your credit score.

Credit score available to existing Ulster Bank customers once opted in through the app if aged 18+ with a UK address. All data provided by TransUnion. App available to customers aged 11+ with a compatible iOS or Android device and a UK or international mobile number from specific countries.

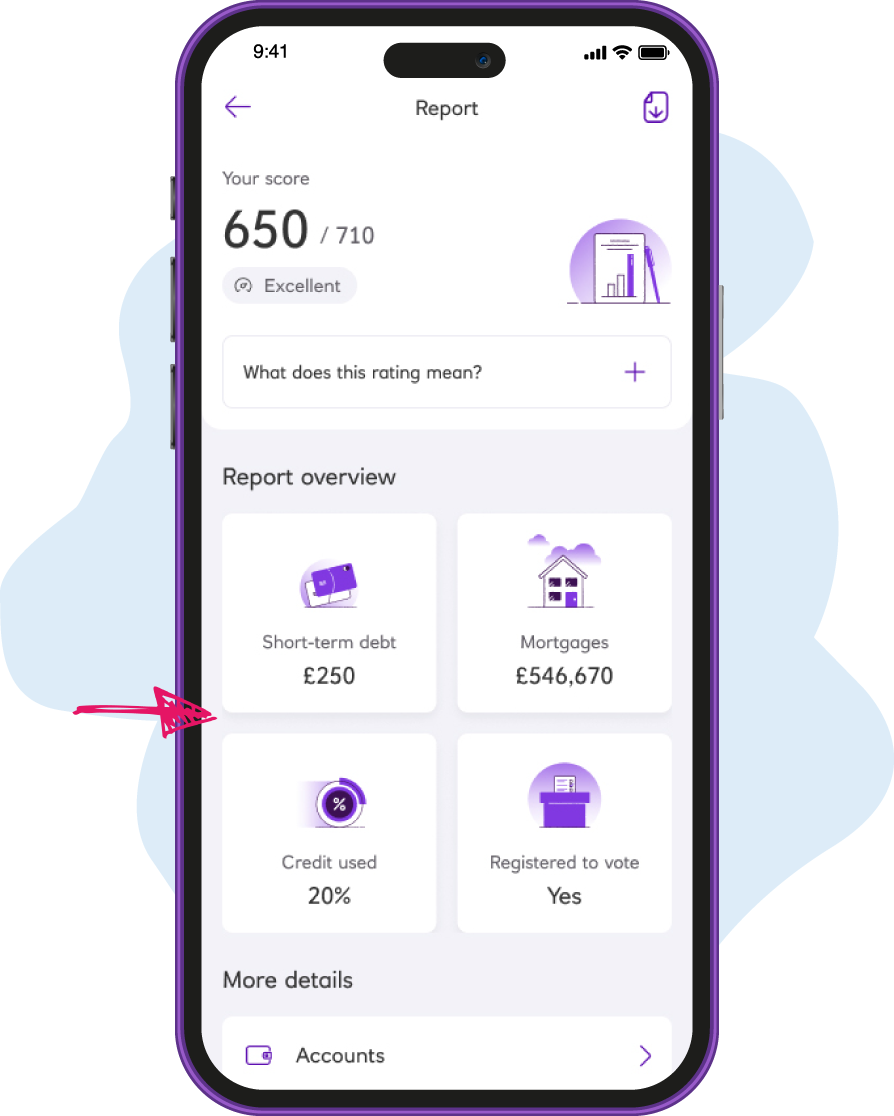

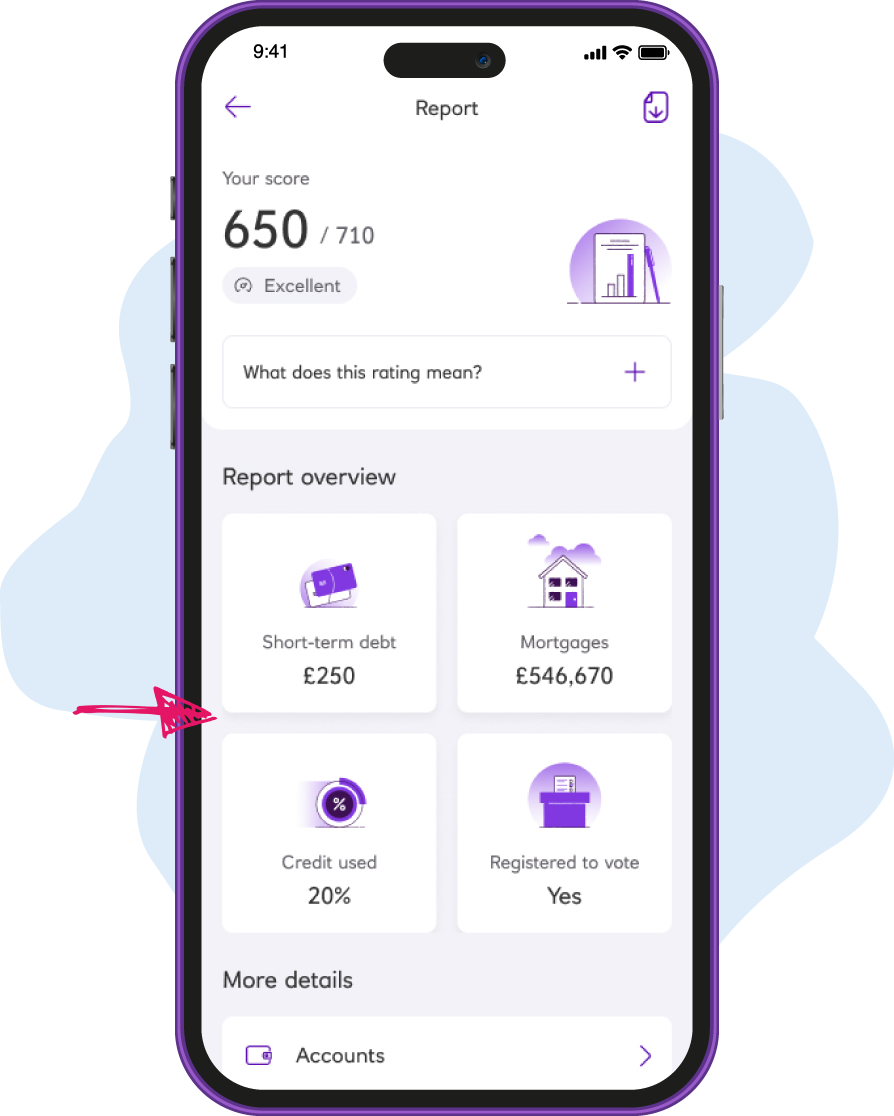

View your full credit report

Including accounts, search history, and personal information.

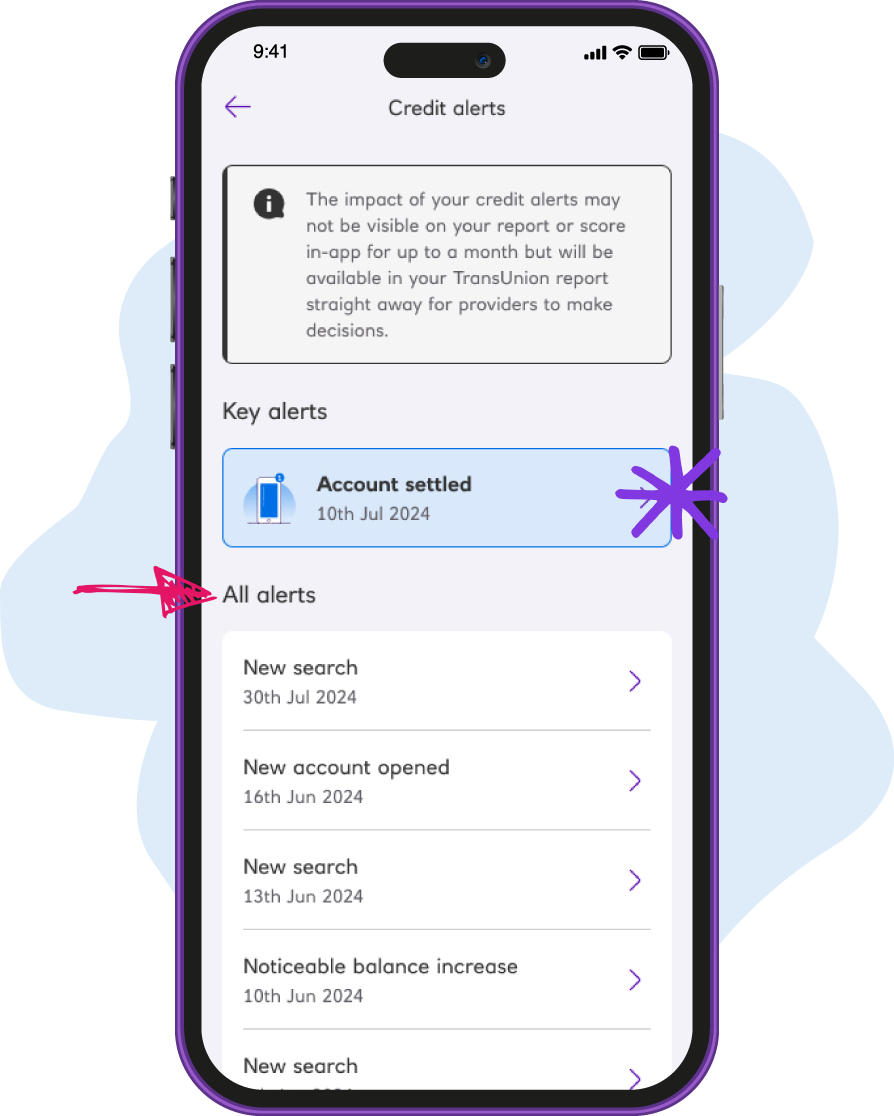

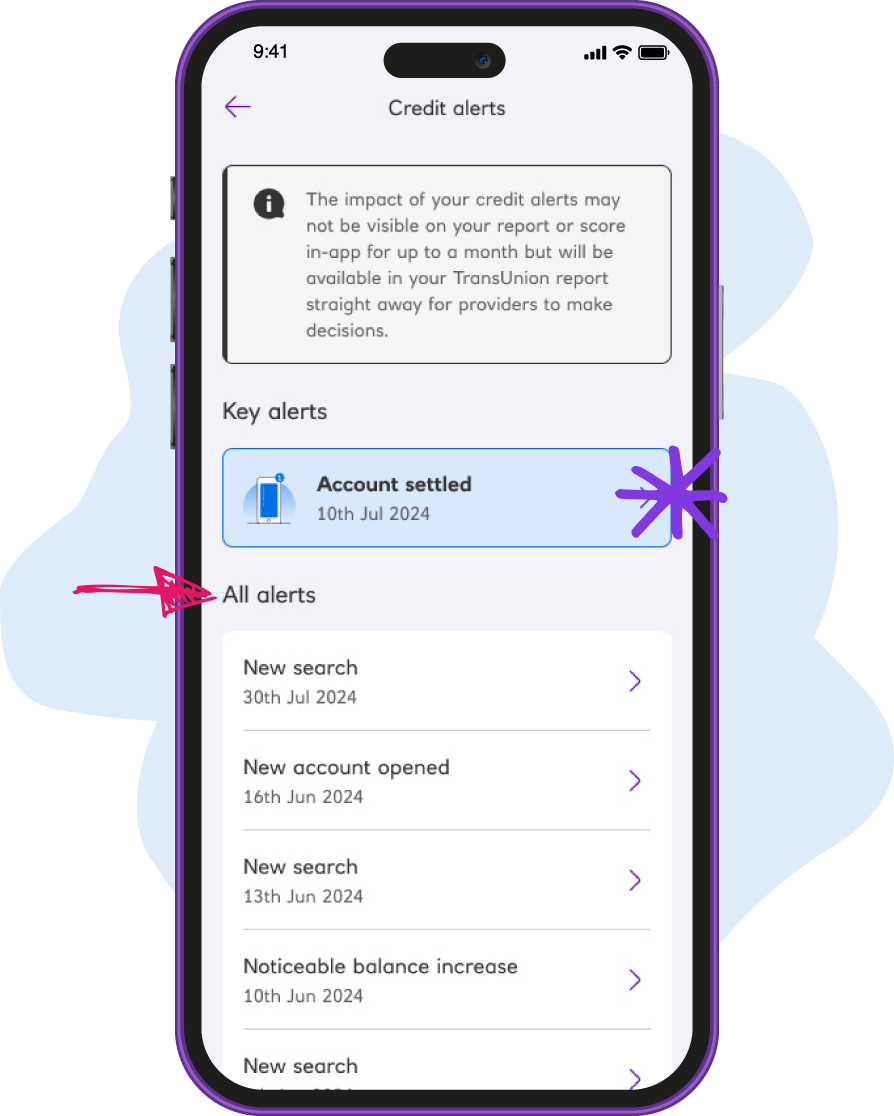

Get alerts when something changes

To stay up to date and help identify fraud.

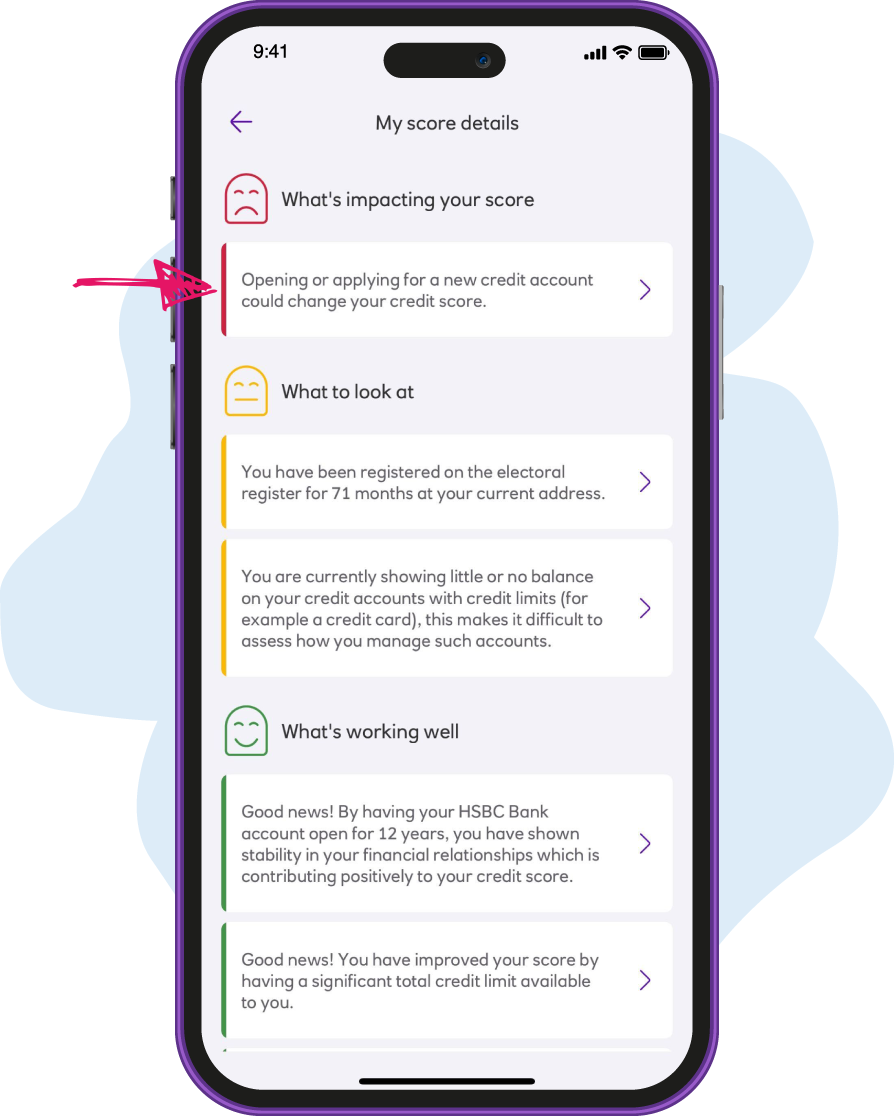

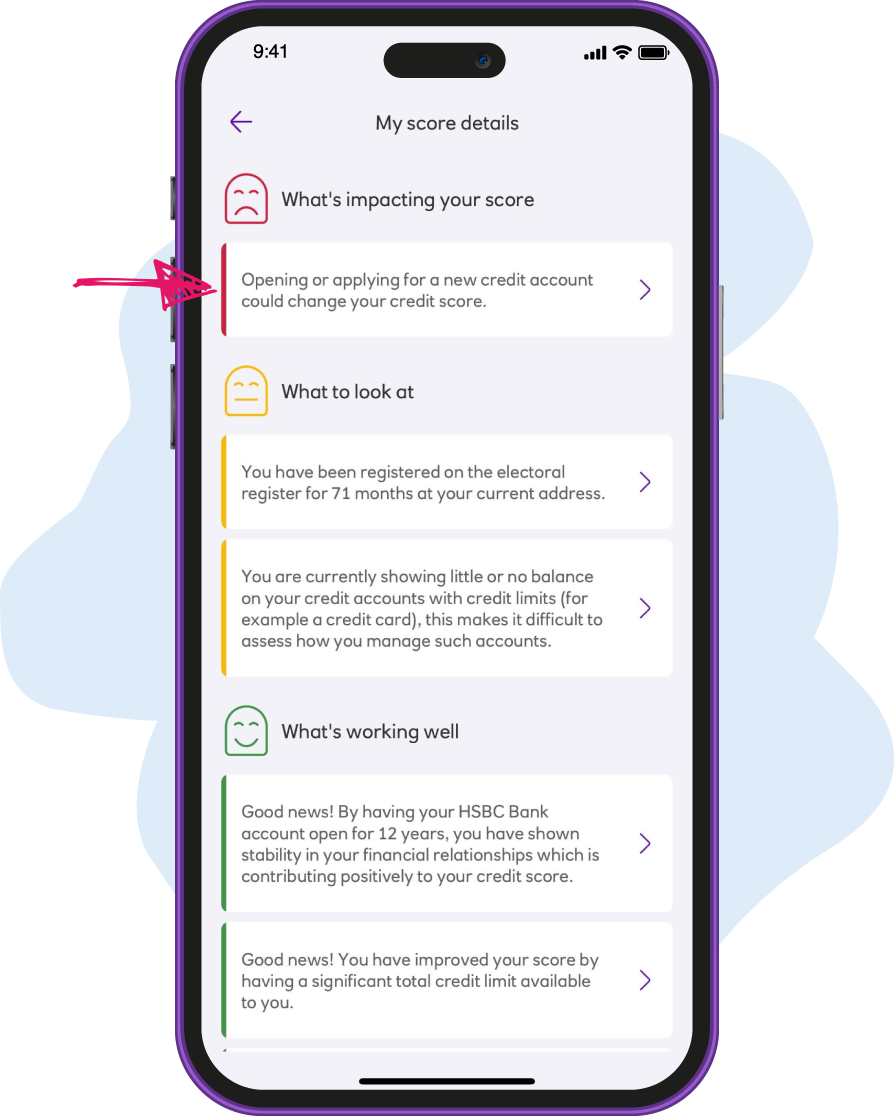

Check what's impacting your score

With personalised insights and tips to improve it.

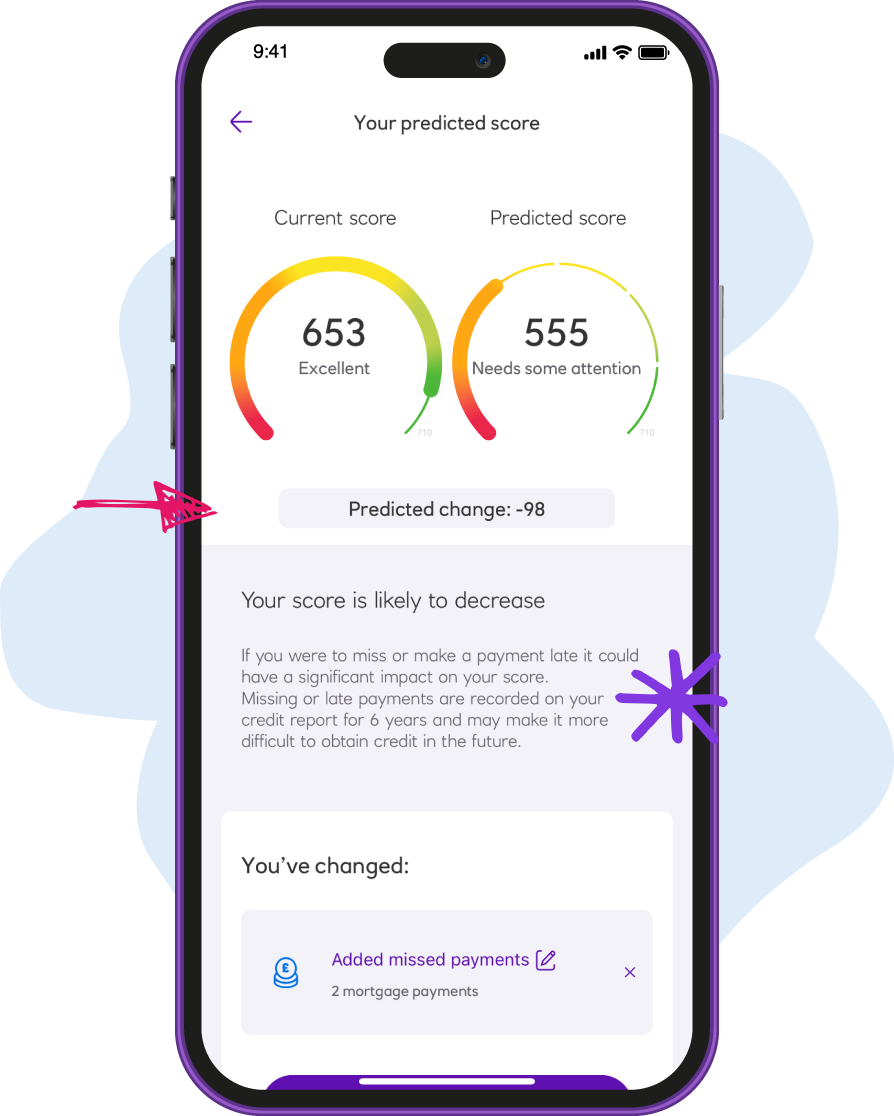

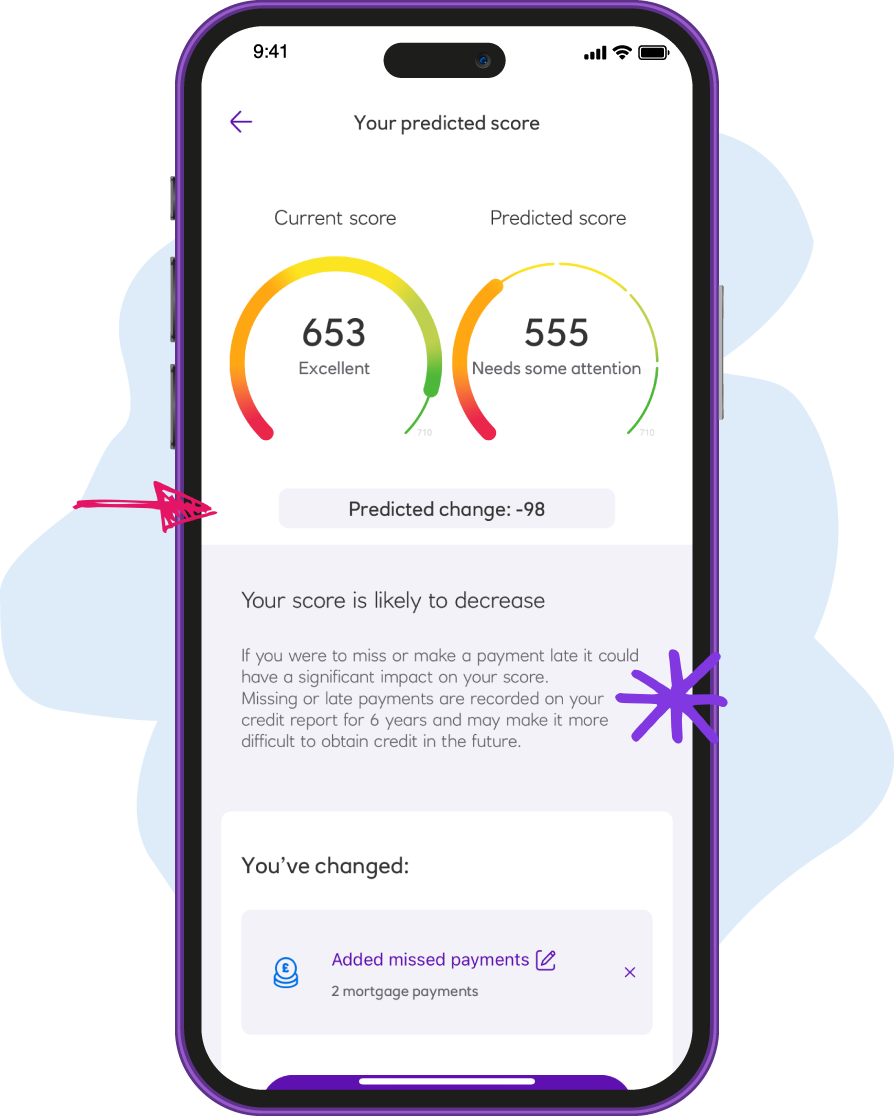

Predict changes to your score

To see how financial decisions will impact your score.

Check your score for free in the Ulster Bank app

From full credit report and proactive alerts to score predictor and personalised insights, we have a selection of features to help you stay on top of your credit score.

Credit score available to existing Ulster Bank customers once opted in through the app if aged 18+ with a UK address. All data provided by TransUnion. App available to customers aged 11+ with a compatible iOS or Android device and a UK or international mobile number from specific countries.