Stop a cheque

The easiest way to stop a cheque is to speak to one of our team:

If you are calling from the UK: 0345 366 5592

Relay UK: 18001 0345 366 5592

If you are calling from abroad: 0044 289 053 8459

Lines are open Mon to Fri 8.30am-5.30pm.

Manage standing orders

You can create, amend and cancel standing orders in Anytime Banking or the mobile app.

- Log in to Anytime Banking, go to ‘Payments and transfers’ then ‘Manage Standing Orders’.

- When using the app, choose the correct account and then select ‘Standing Orders’.

If you don’t have Anytime Banking or the mobile app

Anytime Banking or the mobile app are the quickest and most secure way to set up, cancel or amend a standing order. You can register for Anytime Banking using Set up Anytime Banking.

If your account is not registered to use Anytime Banking, or Mobile Banking you can Contact Us and we’ll help you with your request.

If your account is held in the Channel Islands, Isle of Man or Gibraltar

Visit our Contact us page and get in touch with us to request a new standing order.

See recent payments, transfer money and pay bills

To view recent payments and your account balance, log in to Anytime Banking and you’ll find your balance and available balances on the ‘Account Summary’ page.

You can also view your account balances on our mobile app.

Order account statements

Log in to Anytime Banking, go to ‘Statements & transactions’ then ‘Statements’.

Not got Anytime Banking? You can sign up here. You'll need your account number and sort code.

To change your statement preferences:

You'll need to speak to our webchat team to change the frequency of your statements.

Our team are here to help you 7am to 8pm Monday to Friday, 8am to 8pm on Saturdays, and 9am to 5pm on Sundays.

Click ‘Chat to Cora’ to get started.

Cancel a direct debit

You can do this in Anytime Banking. or our mobile app.

Anytime banking:

Once logged in, got to 'Payments & Transfers". From the 'Direct debits' section, select 'Manage direct debits'. If you need any help, click the support button there.

Mobile app:

From the app, choose the account with the direct debit you want to cancel, then select ‘Direct debits’.

If you don’t have Anytime Banking:

You can cancel a Direct Debit using the digital form below.

The form will ask for the email addresses of the people with signing permissions on the account.

We’ll then email your signatories and ask them to authorise the request.

Update payment limits

Mobile App and Anytime Banking

You can now update your daily payment limits in the mobile app or Anytime Banking. The maximum limit is £50,000.00 per account for Business customers across Anytime, Mobile & Open Banking. Payments made on a Saturday, Sunday or Bank Holiday will form part of the next working day's allowance.

- To change your 'Payment limits' using the Mobile Banking App, tap on the ‘Payments’ icon at the bottom of the screen, select ‘Payments settings’ and then ‘Payment limits’.

In Anytime Banking, select ‘Payments and Transfers’ from the top menu, then on the Payments and Transfers page, select ‘Manage payment limits’ - Select the limit you wish to amend.

- Select the amount you wish your limit to be set to, this can only be changed in increments of £500.00

- Select ‘Next’ to navigate to the next page.

- If decreasing your limit, please confirm the change and your limit will take effect immediately.

- If you wish to increase your limit, please follow the on screen instructions for support. On mobile app, you will need to use biometric approval to complete the limit change.

In Anytime Banking, you will need to provide authentication via Multi Factor Authentication or your card and card reader, depending on what you have set up.

Telephone

Payments via telephone banking are limited to £10,000.00.

Change your business address

You can update your business and or statement address using our digital change business address form.

Change your business name

You can update your business name by using our digital change business name form.

Change your primary contact

You can update your primary contact using our digital change primary contact form.

Change your business contact details

The quickest way to update your business email address and phone number is through the mobile app or Anytime Banking.

In the mobile app:

- Log in to the mobile app.

- Click-on your profile.

- Select ‘Your business contact details’.

- Then just select the business contact details you want to update.

To make changes in the App, you’ll need to be registered for biometric approval.

In Anytime Banking:

- Log in to Anytime Banking.

- Go to ‘Your details’ in the top menu.

- Select the ‘Business’ tab.

- From there, go to ‘Manage business details’ to get your details updated.

To make changes in Anytime Banking, you’ll need to be registered for biometric approval or have your card reader to hand.

If you need any help in registering for either the mobile app or Anytime Banking just click on ‘Chat to Cora’.

Adding and removing cardholders from your OneCard

To add cardholders to your OneCard, please complete and return the additional cardholder application form.

To remove card holders from your OneCard, please complete and return this form.

Please sent the completed form by email to Commercial Cards Account Management.

Or, send by post to:

Ulster Bank

BBNI Customer Support

1st Floor

Donegall Square East

Belfast BT1 5UB

Manage your OneCard limit

You can change your individual cardholder credit limit(s) through our ClearSpend app, or by calling the number on the back of your OneCard.

Certificate of interest

You can order these in Anytime Banking and the mobile app.

Anytime Banking:

Log in to Anytime Banking, go to the 'Statements & transactions' menu and under 'Your statements' select 'Certificates of Interest'.

Mobile app:

From the app, choose the account you want and select ‘Certificate of Interest’.

If you don’t have Anytime Banking:

You can order a certificate of interest using the form below.

It will ask for the email addresses of the people with signing permissions on the account.

We’ll then email your signatories and ask them to authorise the request.

Certificate of balance

You can order a certificate of balance in Anytime Banking.

Log in to Anytime Banking, and click ‘Chat to Cora’. Type ‘Order certificate of balance’ in the chat window. Cora will take the details and process the request for you.

You can also order a certificate of balance using our digital form below.

Manage your account

You can download the PDF form below to open additional accounts for businesses that we already hold accounts for.

To download the form:

- Download Adobe Acrobat Reader (free download)

- Right-click the link below and select 'save as' to download it to your computer (not a phone or tablet)

- Right-click the form in its saved location and select 'Open with Adobe Acrobat Reader’

Download additional account form (PDF, 3MB)

(The form will not open in your browser. Please follow the instructions above.)

To send the form back to us:

- If you’re a business customer (turnover under £6.5m) , email the completed form to Business Banking Support NI.

- If you’re a commercial customer (turnover over £6.5m), please return the completed form to your dedicated service team.

If you need support, call us on:

- Business Banking

0345 366 5592

Relay UK: 18001 0345 366 5592

- Corporate & Commercial Services

0345 601 4817

Relay UK: 18001 0345 601 4817

Close an account

The best way to close your account depends on what kind of account it is.

The best way to complete these tasks is by using these digital forms:

The quickest way to complete the below tasks is through Anytime Banking. If you don’t have access, you can use these forms:

Apply for or manage an overdraft

The easiest way to apply for an overdraft is to log in to Anytime Banking.

If you prefer, you can complete our online application form.

For more information, and to apply, visit our Business Overdrafts page.

Increase or decrease an existing overdraft

Our new online application form is the fastest way to apply for a limit increase to your existing business overdraft.

Making and accepting credit card payments

See how to make and accept credit card payments using Tyl, and check out our currency conversion tool to help you with spending abroad.

Fees and eligibility criteria apply.

Manage your account

You can order cheque books and paying in books by using the digital form below.

Start a chat to manage your account

Cora our digital assistant, can help you complete your account tasks.

Whether it’s best done through Anytime Banking, with an online form, or a chat, we’ll get you to the right place.

Anytime Banking and our mobile app

Sign up for Anytime Banking and you’ll be free to manage your business accounts and finances 24/7.

Register for our mobile app to do your banking from your phone. Together, they’re the quickest way to get things done.

Anytime Banking is available to Ulster Bank business account customers. You can add up to 50 business accounts in Anytime Banking. The mobile app is available on selected iOS and Android devices with a UK or international mobile number in selected countries. Biometric approval is available to eligible mobile app customers aged 16+.

Complete account tasks quickly through Anytime Banking

- Check your balances

- Set up, change or cancel a standing order

- Report your debit card stolen, lost or damaged

- Transfer money between accounts

- Pay a bill or make a payment*

- Manage your savings accounts

- Set up business alerts

*Limits may apply.

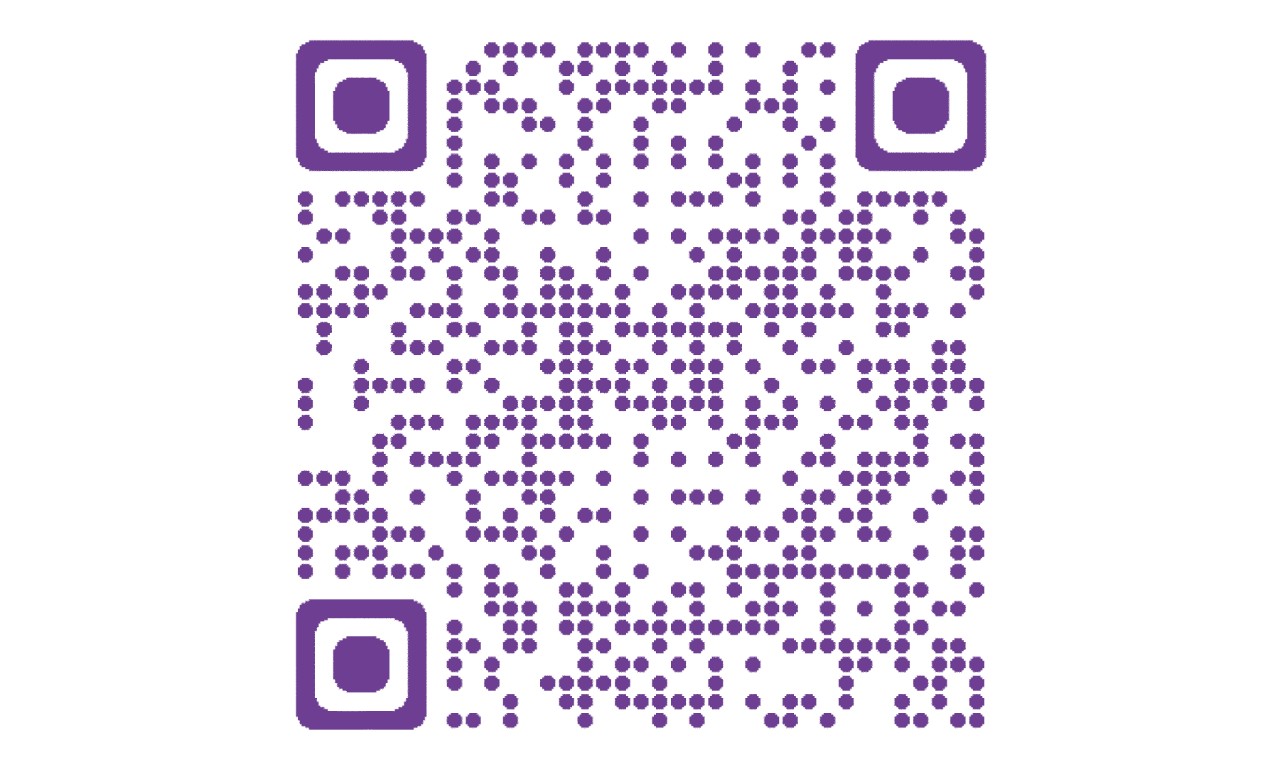

QR code

QR code

Scan our QR code

Scan with your mobile

device to open a

digital business card

in your browser.

Alternatively visit ubbusinesscard.co.uk and download the digital business card.

Add us to your contacts

Add us to your contacts

Click to add

Click on the ‘Add to

my contacts’ button

and our details will

be added to your

address book.

Get in touch

Get in touch

Get in touch

Let us help

you to manage your business banking