On this page

The below products are available to eligible customers who are over 18. Specific account and service eligibility criteria apply.

Free banking on everyday transactions means the charges for the day to day running of your account (known as your service charges) won’t apply during the free banking period. Charges for unarranged borrowing, Bankline, international payments and any additional services are not part of the free banking offer. At the end of your 2 year free banking period, you’ll start to incur fees for your everyday transactions. Not applicable to Mettle.

App available to customers with compatible iOS and Android devices and a UK or international mobile number in specific countries.

Switch offer is available for customers whose projected or existing turnover is below £2m, and who make a full switch to a Ulster Bank business bank account using the Current Account Switch Service (CASS). It's not available to customers switching a NatWest or Royal Bank of Scotland business current account to Ulster Bank. CASS is not currently available for Mettle accounts.

Build on your potential with our Start-up account

On your marks, get set, go! A Ulster Bank account with extra support for your start-up business, plus free banking on everyday transactions for 2 years

- For businesses trading less than a year with turnover of less than £1m

- Free programmes that could help you grow and support that could help you run your business better (some services available to customers and non-customers)

- Connect with experts who could take you further and help achieve your goals sooner

Grow stronger with our Business bank account

Achieve your goals with free banking on everyday transactions for 2 years* when you switch to an Ulster Bank business bank account.

- Our account for businesses with turnover above £1m. Or, for businesses with turnover below £1m who have been trading for over a year.

- If your business has a turnover greater than £6.5m, you’ll need to apply over the phone

- For existing customers, please contact your Relationship Manager to apply for your account

- For new customers, you can start your application online and we’ll pair you with a new Relationship Manager to complete your application, or you can apply over the phone

- Fees apply

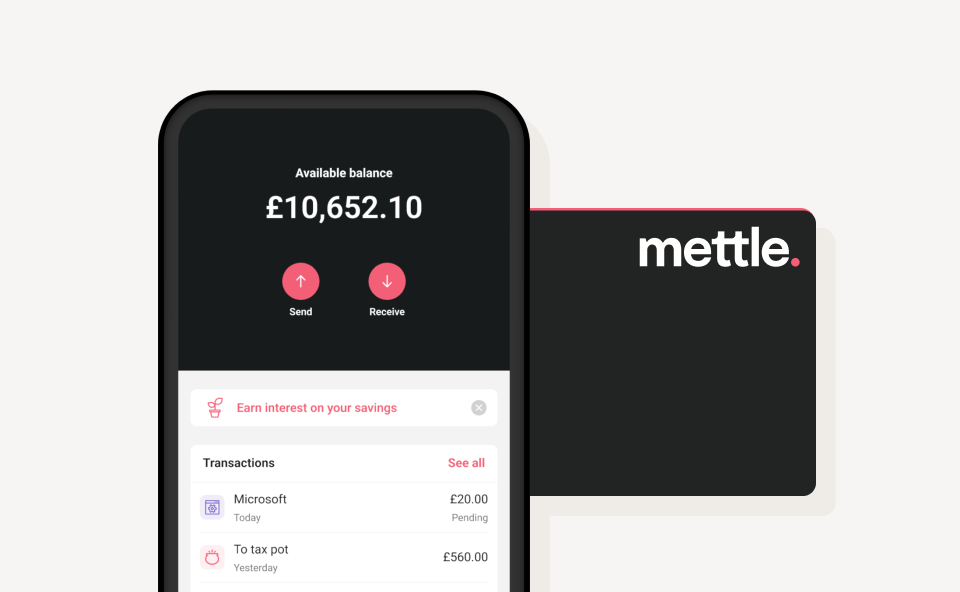

The bank account built for the self-employed

Did you know that Mettle by NatWest supports both sole traders and limited businesses in the UK? Apply in minutes for free digital banking.

It is:

- for sole traders or limited companies with up to two owners

- for businesses who have a balance of less than £1m

- for UK-based companies with owners who are UK residents (eligibility criteria apply)

- a free bank account - no transaction charges

This account doesn't provide access to credit or borrowing options.

Mettle+ is available for an additional charge and includes a quotes and invoicing feature.

Make a big impact with a Community bank account

Charity, club or other non-profit? Check out the Ulster Bank Community account

- Existing Ulster Bank personal or business banking customers are eligible to apply for free banking if your community account's annual credit turnover is less than £100,000 and remains at this level

- Everyday support from texts and email alerts

- Authorise up to four individual signatories

Foreign Currency Account

Only available to existing Ulster Bank customers who maintain a Business Bank Account.

Make and receive payments in foreign currency simply and safely

No minimum or maximum balance

Available in a range of currencies

Free business banking on everyday transactions for 2 years when you switch to a business bank with us

If you've got an annual turnover of up to £2m and switch your business bank account to us using the full Current Account Switch Service, we'll give you 2 years of free banking on everyday transactions.

Everything will be moved across from your old account to your new account for you, all within 7 working days, including Direct Debits and Standing Orders.

Switch offer is not available to customers switching a NatWest or Royal Bank of Scotland business current account to Ulster Bank. Not currently available for Mettle accounts.

Free banking means the charges for the day to day running of your account (known as your service charge) won’t apply during the free banking period. At the end of this period, you'll be charged standard charges for the day to day running of your account. Other charges such as those for unarranged overdrafts, Bankline, international payments and any additional services are not part of the free banking offer.

FreeAgent is included with your accounts

Included with your business account, FreeAgent’s Making Tax Digital-ready software connects to your banking app to deliver real-time insights into your tax, cashflow, and invoicing.

Connect and grow with NatWest Accelerator

Learn how to boost sales, find funding, and sharpen your leadership skills with our expert support. Join the UK’s largest network of entrepreneurs.

What you need to open a business account

Participating providers of UK business bank accounts have agreed to a basic set of information that they will need from you to set up your UK business current account. Find out what you’ll need to provide using the simple business banking account checklist from UK Finance, the UK’s leading trade association for financial services.

See how our accounts compare

If you’d like to see how our business bank account products stack up against the others in the market, you can compare them online at the following websites (suggested by the UK Government's Competition and Markets Authority):

How fees work on our business bank accounts

Business bank accounts can often seem complicated when it comes to charges. We’re here to help you find ways to save and learn more about what you’re charged for. And although Ulster Bank start-up business account holders don’t pay transaction fees for the first 2 years anyway, it’s always worth understanding how you can reduce your charges after that period ends.

Have a look at some of our service measures

If you want to see how we have performed on key service areas, you can get a detailed view here.

Payments by Tyl

Use our simple solution, Tyl, to take payments in-store, online or over the phone (eligibility and fees apply.)

What you need to know before you apply for a Ulster bank account...

It pays to have a business plan

Every successful business starts with a plan. We have six key do’s and don’ts and tips on how to write yours.

Five successful growth strategies

Our experts have put together five ways to help ensure your business is a success. We think it's essential reading.

Scaling up your business

When you're looking to take your business to the next level, we're here to support you.