Get FreeAgent for free as long as you retain your business bank account. Optional add-ons may be chargeable.

Business banking is available to eligible customers who are over 18 and have the right to be self-employed in the UK.

Award-winning accounting software helping small businesses like yours to simplify your business finances since 2007.

Limited companies

FreeAgent helps you stay on top of cashflow and expenses, and relax about tax - including Making Tax Digital (MTD) for VAT.

Sole Traders

FreeAgent helps you nail the daily admin and get ready for Making Tax Digital (MTD) for Income Tax.

Unincorporated landlords

FreeAgent gives you an easy way to manage your property finances, including complying with Making Tax Digital (MTD) for Income Tax.

How can FreeAgent help you plan ahead?

As you reach new milestones, you’ll find FreeAgent is full of user-friendly tools that improve efficiency and keep your business thriving. All of this is included with your free accounting software.

- Pay yourself and your employees and submit your Real Time Information directly to HMRC with fully integrated payroll.

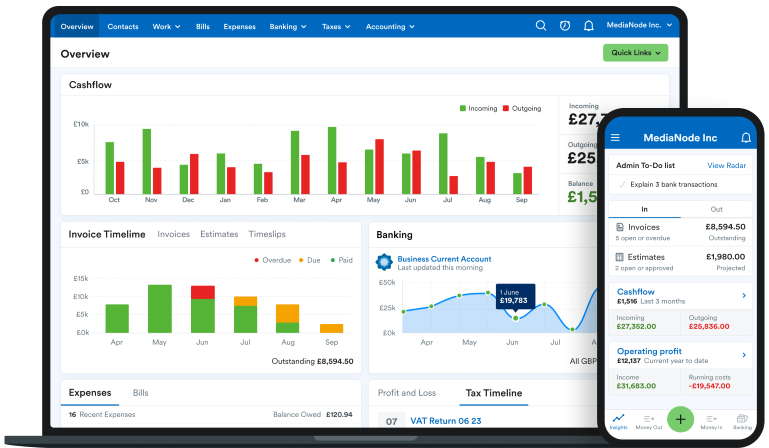

- Make informed spending and hiring decisions with a 90-day cashflow projection.

- Reduce manual tasks with automations that categorise transactions and get you paid faster.

- Streamline admin by integrating with other software, from CRMs to e-commerce systems.

- Add additional users, including your accountant, and delegate admin tasks - also at no extra cost.

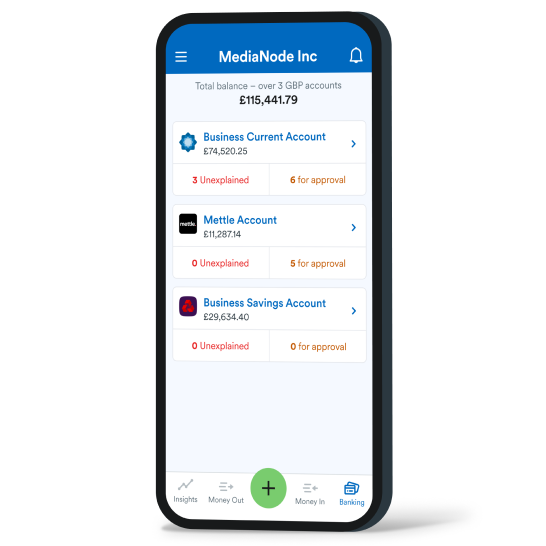

Seamlessly connect your bank account and more

Set up a bank feed and watch all of your transactions flow into your FreeAgent account automatically - plus connect payment providers like Tyl by NatWest, GoCardless and PayPal.

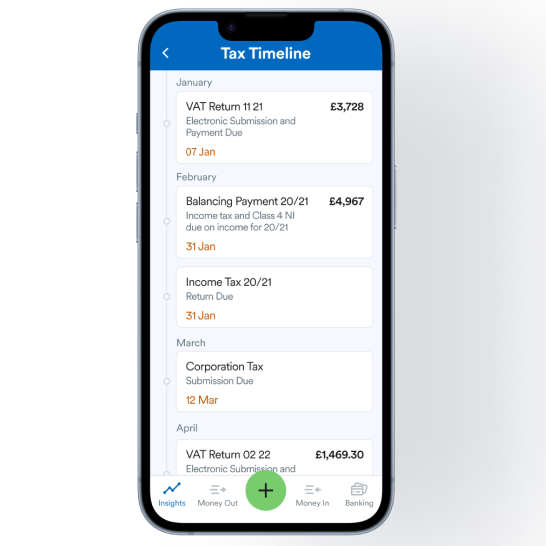

Keep an eye on your tax bill

See a running total of how much tax you owe and when it needs to be paid in the Ulster Bank app, by connecting with FreeAgent.

File tax returns directly to HMRC

FreeAgent is your end-to-end tax solution for Corporation Tax, Self Assessment, Making Tax Digital (MTD) for VAT and the new MTD for Income Tax system.

Organise your outgoings

Track bank transactions, and easily record out-of-pocket expenses and bills against customisable categories to understand your business spending.

Award-winning expert support

If you get stuck, FreeAgent has detailed help articles and a team of friendly, UK-based support accountants available by chat, email and phone.

View real-time insights

FreeAgent uses the data in your account to predict your 90-day cashflow forecast, showing potential shortfalls and offering smart suggestions.

Want FreeAgent for free?

FreeAgent is free for all our business current account customers as long as you retain your account. If you haven’t opened your account yet, take a look at our range of business bank accounts to see how they could meet your business needs.

9 out of 10 small business owners who use FreeAgent say it helps them to feel more confident about their business finances.*

*Small business monitor survey, April 2024

Award-winning, UK-based customer support*, via phone, chat or email, and voted the Friendliest Software** of the year 4 years running.

*2024 UK Customer Experience Awards - SME Silver for Customers at the Heart of Everything

**Friendliest Software of the Year, Institute of Certified Bookkeepers Luca Awards 2025, 2024, 2023 and 2022

“FreeAgent free from my bank has simplified the admin and accounting side of my small business.”

“Don’t pay for software when you can get it for free & TBH FreeAgent is blooming good.”