Log in and set up your profile and users. It’s business time!

Step 2 overview

Now you’ve got everything you need to log in and set up Bankline.

Here’s where your great work from Step 1 pays off. Your planning meeting will have given you the info you need to set up Bankline in the way that works for your business.

We’ll take you through each stage of profile set-up and we’ll share links to useful help resources as we go.

Tip: You don’t have to explore all the resources in each section, we’re just giving you options to choose from.

1. Logging in for the first time

To activate your smartcard and log in for the first time, follow the instructions in our support guide:

You can also refer to the resources below. If you need any help, click the chat button on the log in page. Cora will answer your questions and help you get logged in.

Tips for logging in

Always start from www.ulsterbank.co.uk/bankline, when logging in and go to the login page from there.

Don’t confuse your smartcard PIN with the Log in PIN you’ll create at first log in. The smartcard PIN is just for using with your smartcard.

Once you put in Customer ID and User ID, you can find log in steps on the drop-down on the next screen.

Other resources to help you log in

Setting up your profile

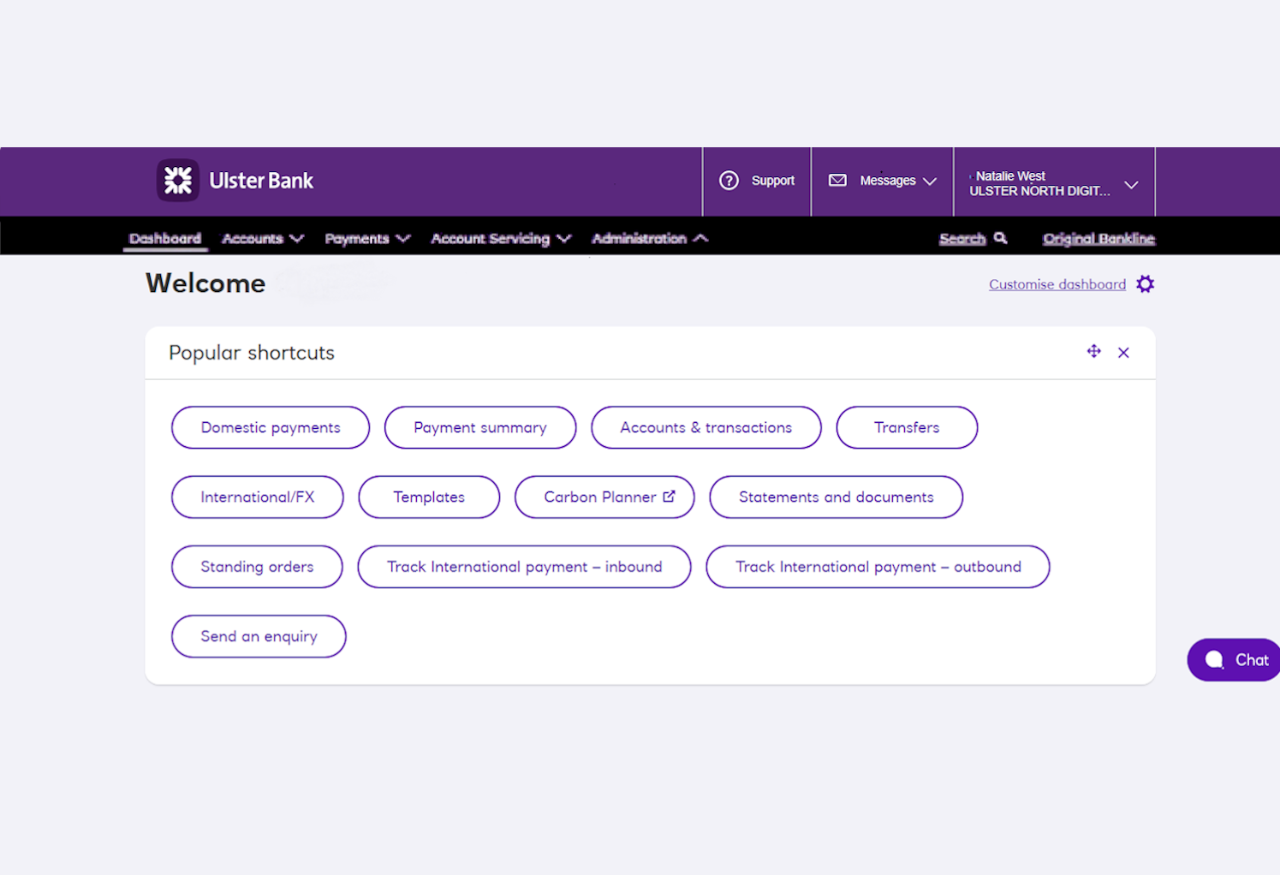

Once you’re logged in, you’ll land on the dashboard.

This is the heart of your Bankline profile. Check out the menu that runs across the top of the screen. This is where you’ll access all features in Bankline, and we’ll flag which section to head to for each part of this profile set-up journey.

2. Adding accounts

Select 'Accounts' in the menu at the top of screen. Here you’ll see all the options that relate to accounts. As an administrator, most of the sections you’ll need will be under ‘Account management’.

When your profile is created your main account will be automatically added. To add more accounts follow the steps here:

Account tips

Refer to the workbook from your planning session, to add the accounts your team has agreed.

If the accounts are connected to your main account they’ll be listed when you go to add them. Don’t worry if you can't see the account you’re looking for, as these can still be registered as ‘account not listed’ or third party accounts.

You can restrict which users can access accounts, we’ll cover this in later sections. Don’t worry if you add accounts in that you don’t want all users to see, this is decided by the custom roles you assign. We’ll cover this later.

Resources to help with accounts

3. Creating custom roles

In Step 1 did you identify any users who would need an adapted master role or a customer role?

If you’ve decided that master roles will work best, then you can skip this section, because we’ll show you how to assign master roles later on when you’re creating users.

If you decided that some customer roles are needed, you can learn how to create them here.

4. Payment limits and controls

This is where you’ll input the limits and controls you discussed as a team in Step 1. You can set them, see how they work in practice, and change them anytime you need to.

Go to the Administration section in the top menu and you’ll find the options to set limits and controls, including:

- Dual administration

- Dual approval

- Dual control of templates and bulk lists

- Profile-wide payment limits

- International payment controls

We’ll cover individual user limits when you’re setting up your users.

Resources for adding limits and controls

Security tips

Tip: If you decide to set stricter approval controls you may want to select ‘IAT exemption’ so users can still move money between your accounts for cashflow purposes.

What is IAT exemption and how do I use it?

Tip: The ‘Total Daily Authorisation Limit’ includes bulk lists, not just individual payments. So if you’re planning to use bulk lists for things like payroll, the limit will need to be high enough to cover those bulk payments.

5. Creating users and assigning them roles

Now it’s time to add your team. You can set them up as Bankline users with the details you collected in the workbook and assign them the roles you agreed on.

To do this, go the ‘Manage users’ section in Administration.

Tips for creating users

Mobile phone number isn’t a required field.

You’ll need to create a unique User ID for each user. It can’t be changed once created, and it’s up to you to share it with the user once they’re set up.

A user's individual authorisation limit is the limit they can authorise a payment up to. It's also the limit that they can approve up to when acting as a second approver on a payment.

Once created and approved, we’ll email the user an activation code, and it will take up to seven days for their smartcard and reader to arrive for UK addresses. More on this in Step 3.

Resources for creating users

Congrats, you've set up your profile!

Time to pause and admire your handy work.

You’ve already got to grips with Bankline and built strong foundations. In Step 3 we’ll help you get your team onboard and set them up for success.

Smartcards for the users you’ve just created will be on their way soon.

If you’re ready to sneak a look at how to support your team or how to make payments, move on to Step 3.

If not, take a well-deserved break. Rest easy, knowing you’ve already done the hard work, and you can join us in Step 3 whenever you’re ready.