Making Tax Digital is mandatory. But with us, paying for it doesn’t need to be. Find out how to prepare, and get compatible software for free with NatWest or Mettle.

Who’s impacted and when

6 April 2026

Most self-employed people and landlords with an income over £50,000 must comply with MTD.

6 April 2027

Most self-employed people and landlords with an income over £30,000 must comply with MTD.

6 April 2028

Most self-employed people and landlords with an income over £20,000 must comply with MTD.

Preparing for Making Tax Digital in four steps

You need to make at least one transaction a month from your Mettle account to get FreeAgent for free.

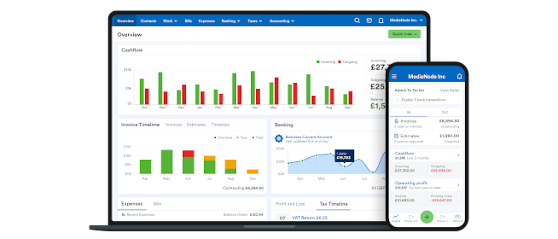

Your compatible software, for free

Are you an Ulster or Mettle banking customer? You’re entitled to use FreeAgent’s accounting software for free. It’s compatible with Making Tax Digital requirements, so you can stay compliant with your new tax obligations.

FreeAgent is free as long as you retain your business current account. Optional add-ons may be chargeable.

Get started with FreeAgent

FreeAgent could help you stay compliant with any MTD obligations. And, it could help you plan ahead by simplifying payroll, reducing manual tasks and streamlining admin.

Ready to sign up? It’s free for Ulster Bank or Mettle customers.

Become an Ulster Bank or Mettle customer

Explore our accounts to find one that best suits your business needs. Our customers will get access to FreeAgent without any cost.

These products are available to eligible customers who are over 18. Specific account and service eligibility criteria apply. Mettle and FreeAgent have optional paid for extras.